Service Details

- Home

- Service Details

Conatct Us

Nidhi Company Compliance

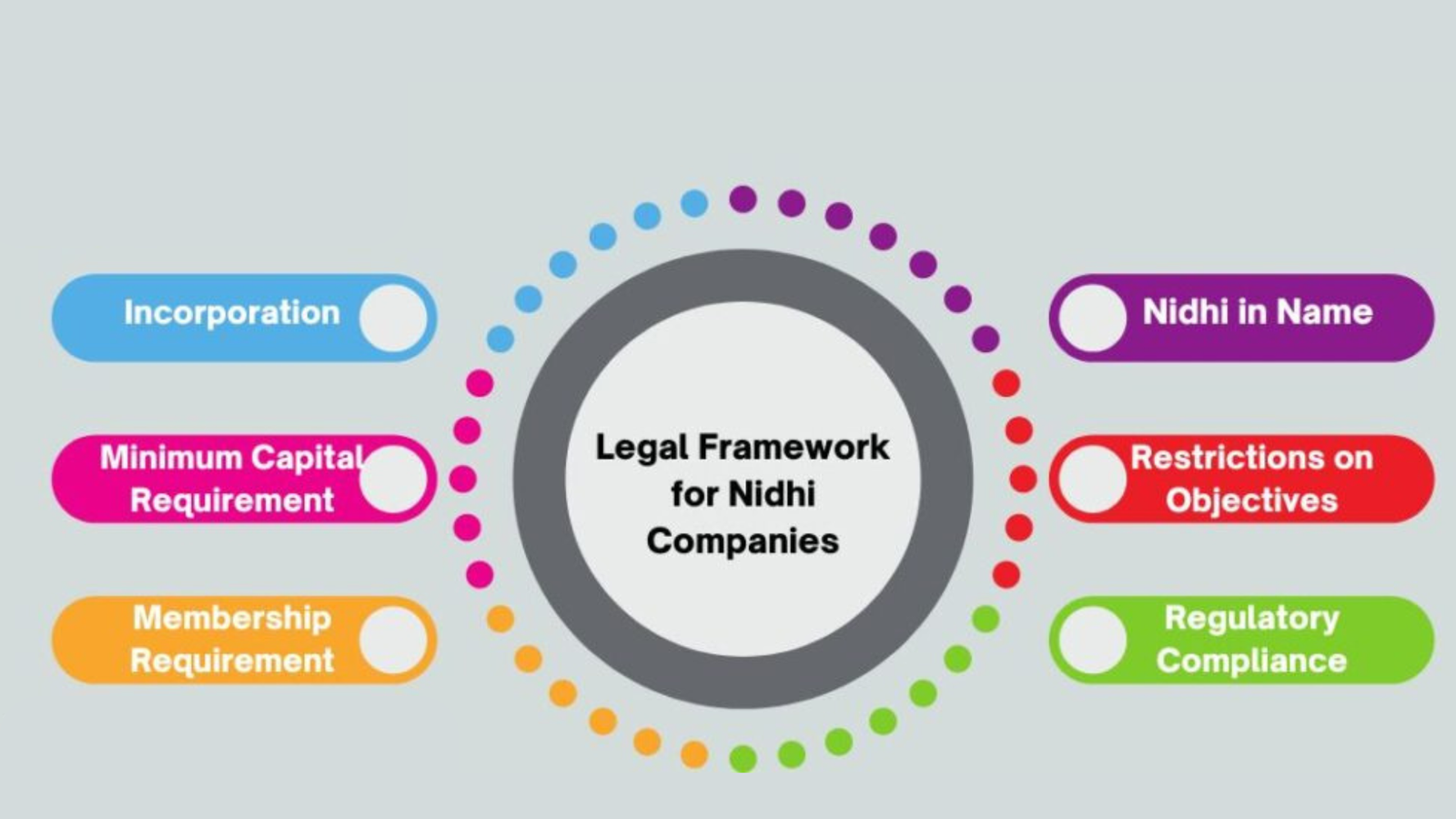

In India, Nidhi Companies, a subset of non-banking financial institutions, play a crucial role in encouraging members’ savings and enhancing financial security. The Indian government has laid down specific rules and compliance guidelines that Nidhi companies must follow to ensure smooth operations and protect the public’s interests. This blog explores Nidhi company compliance in detail, highlighting its significance, benefits, and key factors that these companies must consider. We will also cover some of the important Nidhi company compliance requirements.

Compliance with these regulations is not just a legal obligation but is essential for the ethical and efficient operation of these institutions. Failure to meet compliance requirements can result in penalties and, in severe cases, the dissolution of the company. Nidhi companies must prioritize adherence to regulations across various aspects of their operations, including membership criteria, financial transparency, and tax compliance, to achieve sustainable growth and fulfill their intended goals.

By understanding, adhering to, and staying updated on Nidhi company compliance, these institutions can continue to promote financial inclusion, foster a culture of savings, and contribute to the broader growth of the Indian economy.

List of Annual Nidhi Company Compliance

Here is a list of key annual compliance requirements for Nidhi companies:

NDH-1

Nidhi companies must file the NDH-1 form with the necessary fees and get it approved by an authorized professional such as a chartered accountant, company secretary, or cost accountant. The annual return must be filed within 3 months (90 days) from the end of the first or second year after registration.NDH-2

If compliance requirements are not met, the company must file form NDH-2 to request a time extension. This includes situations where the company fails to:- Add at least 200 members in a year.

- Maintain a net owned fund-to-deposit ratio of 1:20.

Once the form is filed, the director can approve the extension within 30 days from the receipt of the application.

NDH-3

This is an important annual return form that must be filed twice a year by Nidhi companies.Accounts Books

Nidhi companies must maintain up-to-date books of accounts to ensure proper financial tracking and transparency.Statutory Register

Under the Companies Act, 2013, Nidhi companies are required to maintain statutory registers, which is essential for filing annual returns.Convene Statutory Meetings

Nidhi companies are required to conduct statutory board meetings involving the company’s directors and shareholders to ensure proper decision-making and documentation.Financial Report Preparation

Nidhi companies must prepare financial statements, including the Balance Sheet, Cash Flow Statement, and Profit & Loss Account Statement.Income Tax Returns

Nidhi companies must file their annual income tax returns by September 30th of the following fiscal year.Financial Statement Returns Filing (AOC-4)

The AOC-4 form must be filed, containing the company’s financial statements and budget reports, along with any supporting documents.MGT-7 – ROC Annual Return Filing

Nidhi companies are required to submit their annual return to the Ministry of Corporate Affairs (MCA) using Form MGT-7.

These compliance requirements are crucial for the smooth functioning and legal operation of Nidhi companies in India.

New Compliance Rules for Nidhi Companies

The Nidhi (Amendment) Rules, 2022, have introduced enhanced compliance requirements for Nidhi companies:

NDH-4 Submission

Any public company incorporated as a Nidhi, with a share capital of Rs. 10 lakh, must file an NDH-4 form and apply to the central government within 120 days of its incorporation to be recognized as a Nidhi company.Minimum Requirements

To qualify as a Nidhi company, the company must have at least 200 members and a net-owned fund (NOF) of Rs. 20 lakh.Central Government Approval

The Nidhi company must obtain approval from the central government to operate within 14 months after its incorporation.Automatic Approval

If the company does not receive a response from the central government within 45 days of filing the NDH-4 form, the approval is deemed to be granted automatically.

These changes aim to streamline the regulatory framework for Nidhi companies and ensure compliance with the updated standards.