Introduction : GST Registration A Complete Step-by-Step Guide to Apply GST Registration in India is the mandatory applying for all businesses in India. Whether you are a startup, a small scale business or a large business, your business gets ultimate compliance and easy finance quick enough if you get your business GST Registration online. GST is not just about keeping record of tax but apart from record, it allows you to take input credit making your every move searchable. In this article, we will explain all you need to know about GST registration, its benefits, the entire registration process and how it helps your business to grow.

Why GST Registration is Important

GST registration is compulsory for those) person/business with a turnover above the threshold limit (₹20 lakhs for regular states and ₹10 lakhs for the North Eastern and hill states. These are the main reasons why you need to register with GST:

Legal Compliance: Registered firms are in compliance with Indian tax laws, thus preventing fines and penalties.

Input Tax Credit: You can claim a credit on the GST you have paid while purchasing items, which helps to reduce your tax liabilities.

Business Expansion: Having registered businesses is a signal to suppliers and buyers that they can be trusted to scale operations.

Interstate Trade: It is compulsory for companies engaged in interstate trade of goods and services to carry on with the GST registration online.

Government tenders: None Only registered companies May apply / Only ICASA type approvals.

You can even check detailed information provided by authority for GST registration.. on Realtaxindia

Who Should Register for GST?

Not just large business, even small businesses have to register under GST. The categories specified have been mandated to register under GST.

Businesses exceeding the turnover threshold.

E-commerce operators.

Individuals making inter-state taxable supply.

Non-Resident taxable persons and casual taxable persons.

Agents of goods being sold on behalf of another’s goods.

Small businesses too, can opt for voluntary registration of GST to avail its benefits of input tax credit and establishment as a legal entity.

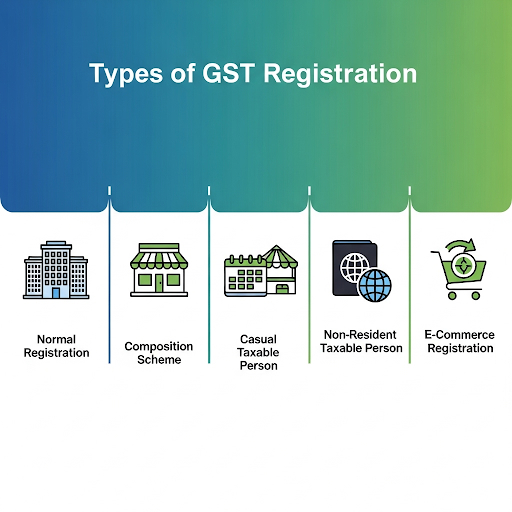

Types of GST Registration

I hope this brings you some clarity around the forms of GST registration is and what form is suitable for your business:

Normal GST Registration : For regular businesses having turnover in excess of threshold limit.

Composition Scheme: A simple and easy scheme under the GST for small taxpayers with turnover up to ₹1.5 crore.

Casual Taxable Person: For such entities who do business for a short term period in the state without any fixed place of business.

Non-Resident Taxable Person: Firms operating outside of India doing business in India.

E-Commerce GST Registration-Compulsory for those selling products on online sites.

Any form of registration category has different rules, benefits and mandatory compliance.

Details to Register for GST in India 2025

GST registration process: Online and easy now! Here are the steps to get registered:

You can do this byjourneying to GST Portal: Simply visit the official GST portal or visit ClearTax GST Registration for assistance.

Make a TRN: Produce a Temporary Reference number (TRN) in order to register.

Complete Registration Form: Details including PAN, business address, bank account, business type.

Upload Documents: PAN card, Business Address Proof, Identity proof, Photos and Bank statement.

Authentication: Either do complete Aadhaar Authentication or sign the application via eSign.

ARN Generation: After the successful submission, ARN will be generated.

GSTIN (Goods and Services Tax Identification Number) Issuance: On successful verification by the GST officer, the issuance of GSTIN takes place.

Documents Required for GST Registration

In order to smoothly go through the process of GST registration, you must have the following documents ready:

PAN card for the business or individual.

Aadhaar card of the owner(s).

Business address proof (rent agreement, electricity bill, NOC).

Bank Account Statement or Cancelled Cheque.

Business constitution evidence (Partnership deed, Certificate of Incorporation etc.).

Facial passport-sized photographs of the proprietor(s) or director(s).

The quicker the approval, the better. And when all paperwork is ready is less waiting, but rather faster approval.

Advantages of GST Registration for Business H owever, it is beneficial or advantageous point for the business as follows –.

There are also a few benefits one can enjoy with GST registration, other than mere legal compliance.

Input Credit: Lower your tax by taking credit for your purchases.

Increased Credibility: Having a business registered builds trust with customers and suppliers.

Loans and Fundings: Banks and investors prefer businesses that are GST-registered.

Interstate Sales: Enabling smooth interstate supplies without paying more taxes.

Digital Compliance: Online filing, assessing, and return submission at GST portal.

These benefits make GST registration a have to have for each and every small business in India.

Common mistakes while registering for GST.

When a business enrolls for GST, they commonly make errors such as:

Incorrect PAN details.

Incomplete or wrong document uploads.

Misclassification of goods or services.

Not updating business address properly.

Disregarding GST return filing deadlines.

Here are the three things to avoid so it’s easy to register and stay compliant for the long haul!

Conclusion

Everyone’s Business in India: GST Registration All the businesses operating in India require GST registration. It not only guarantees compliance with payment of tax, but also gives the benefit of input tax credit, credibility and eligibility for carrying business in government tenders among others. If you follow the correct procedure and take care of the paper work, businesses can do it in no time and derive benefits out of the GST registration.

If you are new to the registration process, then choose trusted portals such as Realtaxindia GST Registration which helps you throughout the process. Make your business GST-ready and avail growth opportunities today!