Annual Compliance for LLP

- Home

- Service Details

Conatct Us

Annual Compliance for LLP

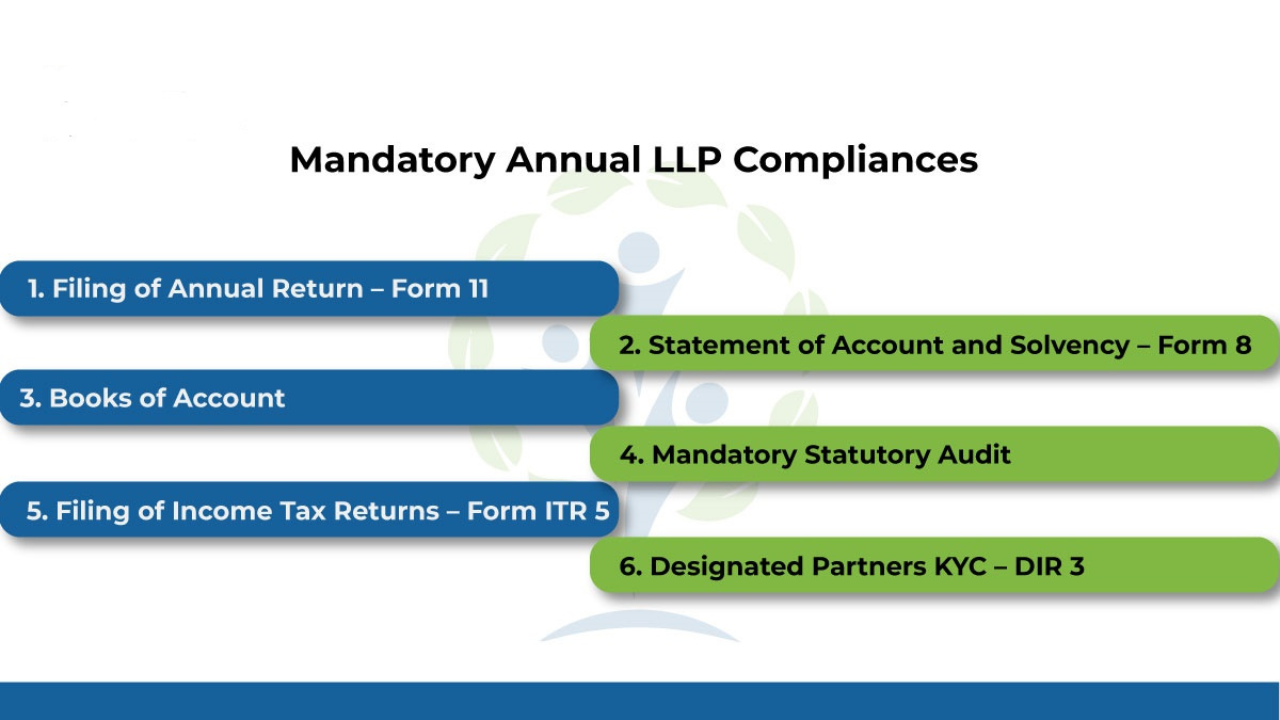

In India, a Limited Liability Partnership (LLP) is recognized as a separate legal entity and must maintain its active status by filing regularly with the Ministry of Corporate Affairs (MCA). Annual compliance filing is compulsory for all LLPs, regardless of whether they are conducting business. LLPs are required to file two separate forms: one for the Annual Return and another for the Statement of Accounts & Solvency. These forms report the LLP’s activities and financial data for each financial year. Failure to meet these requirements results in a penalty of Rs. 100 per day of delay until the filing is completed.

LLPs must file their returns on time to stay compliant and avoid hefty penalties. While LLPs have fewer compliance obligations compared to Private Limited Companies, the penalties for non-compliance can be significant. A Private Limited Company may face fines of up to Rs. 1 lakh, but an LLP can be penalized up to Rs. 5 lakhs for non-compliance.

Benefits of LLP Compliance in India

Here are the key benefits of maintaining LLP compliance in India:

Easy Closure and Conversion of LLP: Annual filings are essential when converting an LLP into another type of organization or company. Regular compliance records simplify this process. The same applies to closing the LLP. Even if the LLP is non-operational, the Registrar may still require compliance to be fulfilled, potentially incurring additional filing fees.

Avoid Penalties: Regular filing of forms helps prevent hefty penalties and protects the partners from being labeled as defaulters. It also avoids disqualification from contracts. Fulfilling the annual compliance requirements ensures that the LLP avoids accumulating penalties until the forms are filed.

High Credibility: Legal compliance is crucial for any business in India. The LLP’s annual filing status is reflected in the Master Data available on the MCA portal, which can be accessed by anyone. For loan approvals or other business needs, compliance serves as a key indicator of the company’s credibility.

Financial Worth Record: The forms filed by an LLP are accessible by other companies, allowing potential partners or investors to assess the financial standing of the business. The annual filings serve as a record of the LLP’s financial health and capacity, which is valuable for entering into significant projects or contracts.

Greater Reputation: Legal compliance is a key factor in determining a company’s reputation. The status of the LLP’s annual filing can be checked through the MCA portal, offering transparency. Compliance is often a primary consideration when evaluating the trustworthiness of an organization, especially when applying for loans or similar financial needs.

Here are the updated points regarding LLP compliance

Number of Partners: Instead of the requirement of 2 designated partners, there can be 5 partners during the incorporation of the LLP, without the need for a Director Identification Number (DIN).

TAN & PAN Allocation: Limited Liability Partnerships (LLPs) will now be allotted their Tax Deduction and Collection Account Number (TAN) and Permanent Account Number (PAN) along with the Certificate of Incorporation (CoI).

Consent of Partners: A web-based Form-9 will be used for filing the consent of partners.

Statement of Account & Solvency: The Statement of Account & Solvency will now be signed on behalf of the LLP by its interim resolution professional.

Web-Based Forms: All LLP-related forms have transitioned to web-based or online submission systems.